THE EDGE OF ACTIVELY

MANAGED ETFs

The advantages of ETFs

Diversification

By investing in an ETF, investors can gain exposure to a diversified portfolio of securities reducing the overall risk of their investments.

Low Cost

ETF expense ratios are generally lower than mutual funds, making them a more cost-effective option for investors. To know more, please check our dedicated page on costs.

Liquidity

ETFs can be bought and sold at any time during market hours on a regulated stock exchange. In addition, investors who wish to purchase or sell large volumes of ETFs have access to the Authorised Participants of the ETFs, which will be able to create or redeem shares directly from the Fund, similarly to the subscription and redemption process of traditional mutual funds.

Transparency

Most ETFs disclose their holdings daily giving investors the possibility to make a more informed decision. Mutual funds are not required to disclose their holdings daily.

Simplicity

ETFs are easily accessible to individual investors on a regulated stock exchange and can be purchased through brokerage accounts, banks, financial intermediaries and financial advisors, like individual stocks. The simplicity of ETFs makes them a popular investment option for individuals and institutions who wish to achieve diversification in their investment portfolio without the complexity of managing individual stocks.

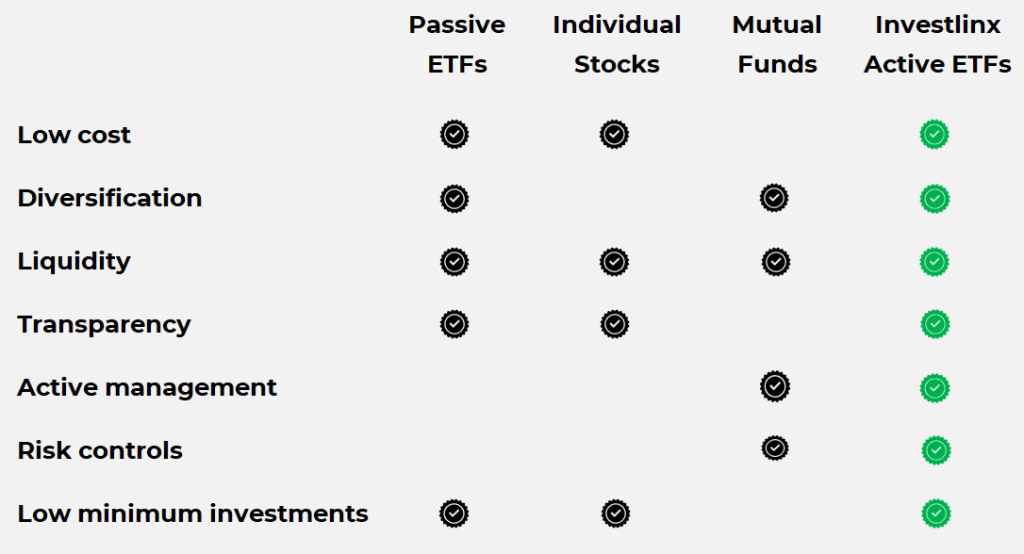

Actively Managed ETFs

While those advantages apply to all ETFs, Investlinx offers ETFs that are actively managed. An actively managed ETF is a type of ETF where the fund manager actively makes decisions about the portfolio composition. In contrast, a passively managed ETF, such as an index ETF, simply holds a basket of securities that tracks a specific market index. Compared to passive ETFs, actively managed ETFs benefit from the ability of the investment manager to analyse the securities to be included in the ETF. Actively managed ETFs can invest in undervalued securities, apply proper risk management and adapt to market changes and shifts in economic conditions.

Compared to mutual funds, active ETFs offer greater flexibility and transparency as they trade on an exchange like individual stocks, allowing investors to buy and sell them throughout the trading day at market prices. In addition, Investlinx’s active ETFs tend to have lower expense ratios, resulting in lower costs for investors (please refer to the Lower Costs section for details). Moreover, active ETFs provide visibility into their holdings by publishing them daily, enabling investors to monitor the portfolio’s composition and make informed decisions. Finally, investors can purchase as little as a single share of an active ETF, which allows for greater accessibility and flexibility. On the other hand, mutual funds often have higher minimum investment thresholds, which can be a barrier for smaller investors or those looking to diversify their portfolio with smaller amounts of capital.