LOWER COSTS

OUR COSTS ARE FAIR, SIMPLE AND TRANSPARENT

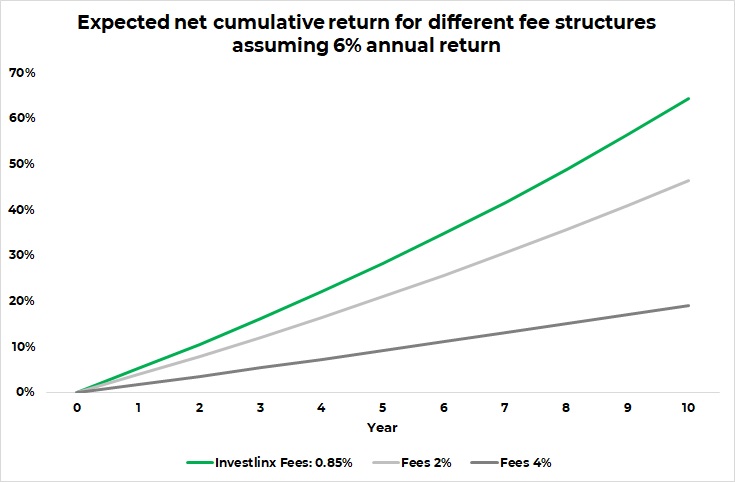

Costs are one of the most important factors when making investment decisions, as they impact investors’ returns and may create conflicts of interests between Fund Managers and their investors.

Our ETFs are costs effective with a total expense ratio 39% lower than comparable funds in Europe1, bringing significant economic benefits to investors.

Our costs are transparent. We only charge a total expense ratio2 of 0.85%, which gives investors certainty of their costs and avoid unpleasant surprises of incurring higher costs than initially envisaged.

We do not charge performance fees, as we believe they are unfair. If performance fee are charged, investors would bear all the losses in case of negative fund’s performance but they would have to share a meaningful percentage of their profits in case of positive performance. Also, performance fees may create a bias in investment decisions as Fund Managers may be inclined to increase the returns, and hence risks, of their funds to maximize their performance fees.

We also do not charge entry fees, exit fees or any other hidden fees to give investors freedom to deploy or redeem their capital without having to incur any costs.

Our 0.85% total expense ratio is the same for all our Funds. This is in contrast to the rest of the investment management industry where equity funds usually have higher costs than balanced or flexible funds.

In addition, all our ETF products have the same costs for private and professional investors, giving the opportunity to our retail investors to pay the same costs and have the same investment returns of large institutional investors.

LOWER COST

THE NUMBERS

1. Comparison between Investlinx ETFs Total Expense Ratio (TER) and the average expense ratios of Equity funds and Allocation funds distributed in Belgium Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, UK.. Source: Morningstar “Global Investor Experience Study: Fees and Expenses” research, March 30th 2022.

2. Please refer to Prospectus for details of the Total Expense Ratio.

The power of compounding